Did you know Medicare premiums can change year to year based on your reported income?

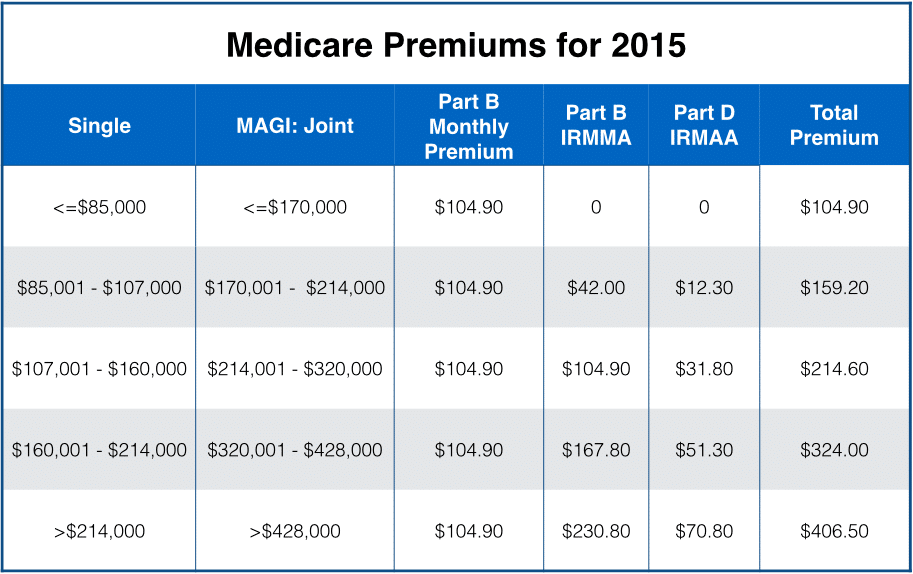

If your adjusted gross income (AGI) plus tax exempt interest is over $85,000 for single taxpayers or $170,000 for married couples, you will be subject to the income related monthly adjustment amount (IRMAA) in addition to your regular Part B and Part D premiums.

To determine your Medicare premium the Centers for Medicare and Medicaid Services looks at your tax return from 2 years ago. So for 2016 they will base your premium on 2014 tax return. The new rates are announced in October for the following year. Below is a table showing premiums for Part B & D for 2015 based on varying income levels.

Medicare premiums do not rise based on some set benchmark such as the CPI. Instead premiums are determined by the actual cost of care as projected by the Centers for Medicare and Medicaid Services. When Medicare was first established the Medicare premium was $3!

When to sign up for Medicare

If you are still working at 65 for a company that employs less than 20 people you MUST sign up for Medicare Part B. If you are 65 and on COBRA you MUST sign up for Medicare Part B. For every 12 month period you do not have Part B coverage after 65 you will pay a permanent 10% penalty with every premium you pay.

When you’re first eligible for Medicare, you have a 7-month Initial Enrollment Period to sign up for Part A and/or Part B. It begins 3 months before you turn 65 and lasts 3 months after the month your turn 65.

The General Enrollment period is between January 1 and March 31 each year. Coverage will begin on July 1. You may pay a higher premium for Part B & D during this period if you should have signed up for Part B & D in June of the prior year or earlier.

Medicare Special Enrollment Period

If you’re covered under a group health plan based on current employment, you have a Special Enrollment Period to sign up for Part A and/or Part B any time as long as you or your spouse (or family member if you’re disabled) is working, and you’re covered by a group health plan through the employer or union based on that work.

You also have an 8-month Special Enrollment Period to sign up for Part A and/or Part B that starts the month after the employment ends or the group health plan insurance based on current employment ends, whichever happens first. Usually, you don’t pay a late enrollment penalty if you sign up during a Special Enrollment Period.